How do you begin building wealth as a Millennial? Millennials have been struggling with this question more than any other group due to the student loan crisis.

Everybody wants to be financially stable and wealthy, but unless you have a plan to get you there, it’s not going to happen. As Millennials, you have the unique opportunity to begin building wealth while time is on your side. Following some Golden Rules can help you keep and grow your money, and it’s easier than you think.

Where do you start? You start with Building your Financial Foundation.

- 1. Live Within Your Means

- 2. Have More Money at the End of the Month by Budgeting

- 3. Save at Least $1,000 to Start Your Emergency Fund

- 4. Pay Off All Debt (Except the House) Using the Debt Snowball

- 5. Don't Borrow: If You Have To Borrow, You Can't Afford It

- 6. Buy Value

- 7. Pay Attention to Your Credit Cards and Leave Home Without Them

- 8. Pay Your Bills Ahead of Time

1. Live Within Your Means

2. Have More Money at the End of the Month by Budgeting

Having more money at the end of the month sounds WAY better than having more month at the end of my money. Doing a budget is foundational to Building Millennial Wealth because it simply tells your money where to go. If you’re not good at budgeting yet, that’s okay! It takes a little time. By your third budget, you’ll be a pro.

Track your spending– If you don’t have a budget, then you probably don’t have even a remote idea where all of your money is going. This is one of those good financial habits you absolutely must adopt you if want to get control of your finances.

By watching where you spend your money, you will be able to identify the areas of excess. Eating out for 50% of your meals? Cut that back to even 25% and cook or brown bag the rest, and you’ll have a nice chunk of change to contribute to paying down debt or building up your savings.

Paying attention to your money is not only intelligent, but it is also crucial to Building Millennial Wealth. You may be surprised to find where your money is actually going.

You might think that the entire point of budgeting is to restrict you. And, there’s a little truth in that. See, it helps (a lot) if you spend less than you earn.

Think of a budget as a lifestyle design blueprint. It’s a working plan for taking your life from where you are now, to where you really want to be: zero debt. Homeownership. Retirement plans. Travel.

More money for eating out. Much less frustration and anxiety. Pick a goal that speaks to you and budget your way to success!

Try digital budgets like YNAB and Every Dollar to make this not so dreary task -simpler.

3. Save at Least $1,000 to Start Your Emergency Fund

Sell something

You probably saw this coming. If you take a couple of hours to look around the house, you’ll be amazed at how many items (old kids’ toys, exercise equipment, dusty power tools, etc.) you could convert to cash. That’s much better than offering to pay your mechanic for a new alternator with an old treadmill that hasn’t run since Carl Lewis did.

Have a yard sale, sell a car, sell old furniture, you get the idea.

Find one-time income opportunities.

There are lots of chances to do some quick work and earn bucks inside and outside your home. Someone I know drove both Lyft and Uber while holding down a full-time job.

You can answer online surveys, care for pets while their owners are on vacation, participate in focus groups, and more.

![]()

Get a second job.

None of us likes the thought of pulling extra hours when we’re already tired, much less being away from our families for that much longer. It’s temporary!

But even four weeks of an extra job can make a huge difference when an emergency arises, like your car needs repairs or your AC goes out. At that point, you’ll be relieved that you worked extra, rather than being disappointed you didn’t.

![]()

Make cuts in your budget.

Look at your budget and do a bunch of little cuts that you won’t notice individually but add up significantly. Turn the thermostat down a degree or two, clip some coupons, and cancel unnecessary services or memberships. There are plenty of ways to save money, use your imagination.

4. Pay Off All Debt (Except the House) Using the Debt Snowball

Debt is a funny thing. You need to have a history of paying down debt to improve your credit score. Having little to no debt improves your ability to Build Millennial Wealth. I will share ways to use debt to improve your credit score later.

Creating an emergency fund should be a top priority. But once you have accomplished this goal, use any funds at your disposal to pay down debt. The more you pay, the faster you’ll be free of your obligations.

Did you save money at the grocery store by stacking coupons with sales? Use the savings to pay off debt. Did you work some overtime last week? Apply the extra earnings to your debt.

Any extra money you find or earn should be thrown at your debt. Here’s the systematic way to pay off debt.

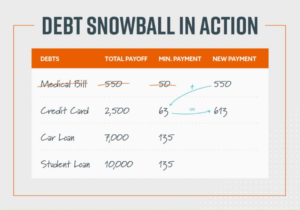

You will be using the debt snowball method to pay off debt. More than 5 million have beaten debt this way. It is the most effective way to pay off debt.

The debt snowball method is a debt reduction strategy where you pay off your debt, in order of smallest to largest, gaining momentum as you knock out each balance. When the smallest debt is paid in full, you roll the money you were paying on that debt into the next smallest balance.

It looks something like this:

Step 1: List your debts from smallest to largest regardless of the interest rate.

Step 2: Make minimum payments on all your debts except the smallest.

Step 3: Pay as much as possible on your smallest debt.

Step 4: Repeat until each debt is paid in full.

Being debt-free allows you to invest what you would pay on bills and start your journey to Building Millennial Wealth.

5. Don’t Borrow: If You Have To Borrow, You Can’t Afford It

Credit is an awesome thing when you’re buying something big, like a house or a car. Very few people have $150K sitting around in cash to buy a home, so for those things, borrowing makes sense.

But adopting good financial habits means you must avoid schemes to stretch your paycheck. Credit cards are probably the most common of these and make it easy to buy things you cannot afford.

6. Buy Value

When I say buy value, I mean you neither by the cheapest goods, nor the most expensive. Instead, you look to buy the best value for the money. Sometimes it’s worth it to cough up a little extra dough for a product you know will last, rather than paying bottom-dollar for shoddy merchandise you’ll have to constantly replace.

If I am looking for something that I have to have, I browse Craigslist or OfferUp to see if it is available there.

On the flip side, keep in mind not all products are better simply because they’re more expensive – often they’re just more expensive because of perception. Read reviews and shop around.

7. Pay Attention to Your Credit Cards and Leave Home Without Them

It’s a good idea to SHOP WITHOUT YOUR CREDIT CARDS. I don’t mean to shout but there are so many temptations out there. By leaving your credit cards at home, it will keep you from running up your credit card balances.

If you have to use cash or your debit card to make your purchases, there’s a very good chance that you will spend less money. It’s real money, being used right now, which helps you make a wiser decision in the checkout line.

Another strategy for Building Millennial Wealth is to get rid of those credit card balances every month.

If you can, you should consider consolidating your credit card debt under a single 0% balance transfer card. Once you do this, all those high-interest cards will be under a single zero interest card saving you money.

This will speed up the payoff of your credit cards in your debt snowball without having to come up with huge sums of money to do it. You will simply be accelerating the payoff, and if you pay enough, it will happen more quickly than you think.

Pay attention to your credit card statements. They will often tell you how long it will take to pay off your balance if you only pay the minimum payment, and how long it will take if you pay a fixed amount slightly higher than the minimum payment. Most of the time, there’s a difference of several years. Yes, I said years.

8. Pay Your Bills Ahead of Time

Paying bills late is another strategy to stretch the paycheck. But it’s also kind of like robbing Peter to pay Paul.

All it does is give you a false sense of how much money you have, and then puts you under tremendous pressure to cover the difference later. By paying your bills ahead of time, you will gain more control over your finances, and that will make it easier to adopt good financial habits.

I am an expert at this. Instead of waiting until I receive our credit card bill, I log into my account and pay it off in the middle of the month. There’s no way I’m allowing any interest to accrue!

So there you go – The first 8 financial habits to start you on Building Millennial Wealth Pick just a few of them, and watch your finances get better.

Now you are ready to start the second 8 financial habits to Building Millennial Wealth.

Be on the look out for Part 2!